TECHNOLOGY SOLUTION

Transform Banking with Cutting-Edge Solutions

At Techno Core Logic, we deliver tailored Digital Transformation Solutions for banking and finance, enhancing efficiency, streamlining customer experiences, and ensuring secure, compliant operations with advanced personalization.

Trusted by the world’s most ambitious teams.

KEY FEATURES

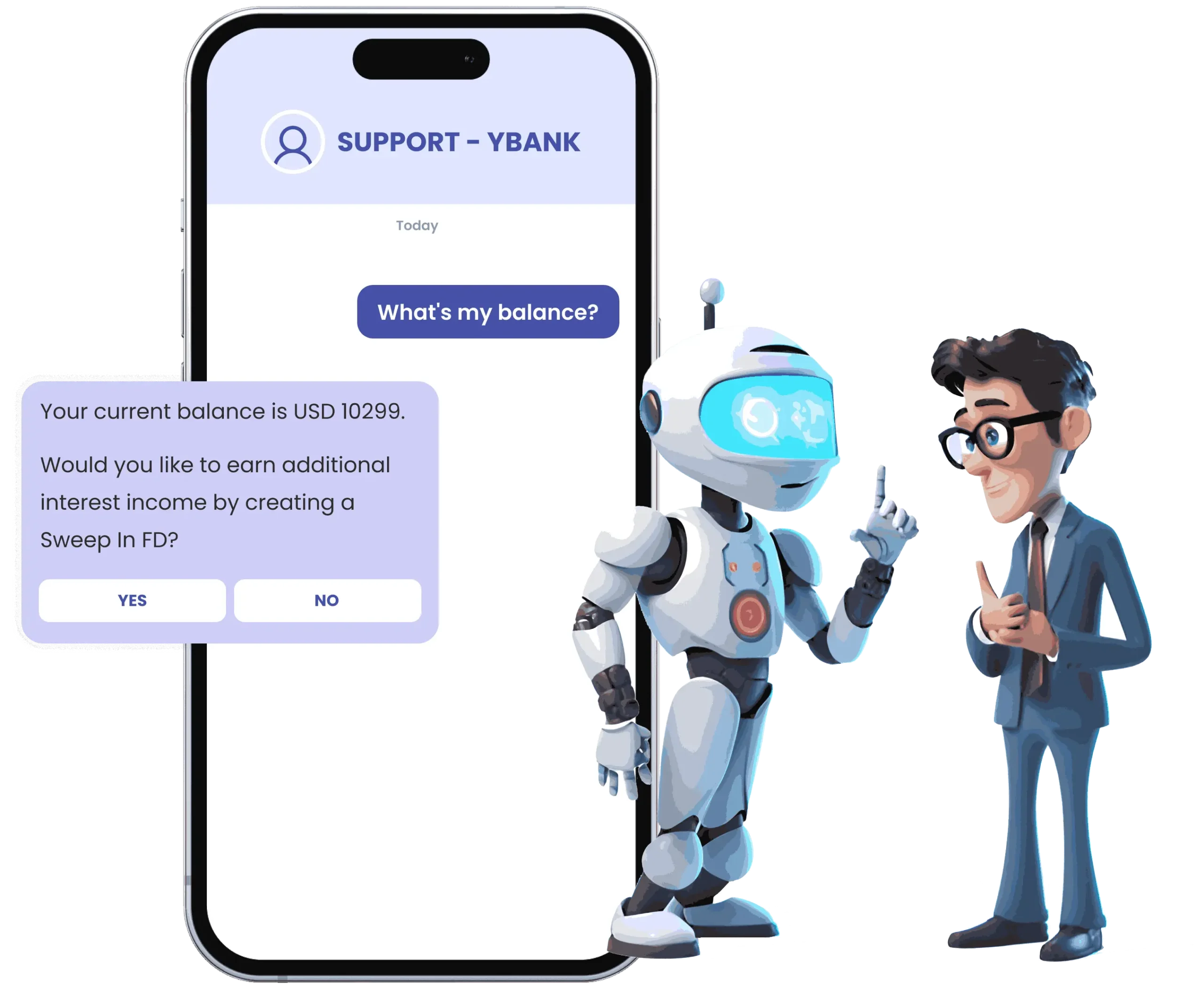

Customer Support and Query Resolution

- Instant customer support for queries about account balances, transactions, loans, credit cards, and more.

- Chatbots manage routine queries, with complex issues escalated to human agents for efficient resolution.

Transaction Notifications and Alerts

- Receive real-time notifications for transactions, account activities, credit/debit alerts, loan EMIs, investment maturities, and payment reminders.

- Ensure secure operations with OTP-based authentication for added protection.

2-Way Conveyance for Transactions

- Facilitate secure and seamless transactions via WhatsApp, such as bill payments, fund transfers, and recharge requests.

- Use OTP-based authentication to ensure the highest level of security for all operations.

Personalized Marketing and Promotions

- Tailored offers and services based on customer profiles and preferences.

- Promote financial products like loans, insurance, or mutual funds through engaging and targeted messaging.

Document Submission and Verification

- Simplify KYC document uploads, loan applications, and more via WhatsApp.

- AI-powered verification accelerates processing and ensures compliance.

Interactive Educational Content

- Empower customers with financial knowledge through tutorials, tips, and guides.

- Offer engaging videos and infographics to help customers make informed financial decisions.

WHY CHOOSE US?

Tailored Solutions for Your Business Needs

We offer industry-specific solutions focused on security, compliance, and customer satisfaction, driving your business’s digital transformation and operational efficiency.

Industry-Specific

Expertise

We understand the banking and finance sector's unique compliance, security, and customer engagement requirements.

Seamless Integration

across channels

Our unified platform supports SMS, email, WhatsApp, voice, and in-app messaging, delivering consistent customer experiences in real-time.

Advanced Security

Measures

Adhering to top-tier security protocols like GDPR, CAN-SPAM, and PCI DSS, we prioritize data encryption and regulatory compliance.

AI-Driven

Personalization

Our AI solutions enhance customer interactions with tailored messaging, boosting engagement and satisfaction.

Scalable and Future-

Ready

Whether you’re a large bank or financial institution, our platform scales with your business, adapting to evolving customer needs.

24/7 Support and

Reliability

We ensure uninterrupted service, offering robust support so your team can deliver exceptional customer service anytime.

FAQs

Got Questions? We’ve Got Answers!

How do your solutions improve transaction security?

Our platform integrates secure communication solutions such as OTP verification and end-to-end encryption to ensure all financial transactions are safe.

Can customers submit documents via WhatsApp?

Yes, customers can securely upload KYC documents, loan applications, and other necessary paperwork via WhatsApp, and our AI system verifies the documents for compliance.

How do your solutions help in digital transformation?

We provide solutions that enhance customer experiences, streamline operations, and improve service delivery, helping financial institutions achieve digital transformation.

Can I track transaction notifications in real-time?

Yes, our solution sends real-time notifications about transactions, credit/debit activities, and important account events, ensuring customers are always informed.

What kind of marketing solutions do you offer?

We offer personalized marketing tools that help banks promote financial products, such as loans, credit cards, and insurance, based on customer preferences.

Are your solutions scalable for large institutions?

Absolutely! Our solutions are designed to scale with your organization, providing flexibility to meet the demands of growing financial institutions.

Ready to Revolutionize Your

Banking Services?

Experience the power of digital transformation and secure communication solutions. Let’s optimize your customer service, improve operational efficiency, and drive growth.